Relation between Investment Multiplier k and MPS Chapter 4 Part 2

Other resources of production are also easily available within the economy. Consumer goods are available in response to effective demand for them. There is less than a full-employment level in the economy.

Instead, as per the general practice, they save a portion of their income. In the next round, 90% of the additional income of Rs 90 crores, i.e. Rs 81 crores will be spent on consumption and the remaining amount maximum value of investment multiplier will be saved. This multiple contraction of income is on account of the reverse operation of investment multiplier. Suppose there is an initial rise in autonomous investment in a country by Rs.100 crore.

Investment Multiplier – Concept, definition, formula working (Class

Multiplier expresses the relationship between an initial increment in investment and the resulting increase in aggregate income. Let us assume that the government has come up with an investment of $2,00,000 in the infrastructure project in the country. This additional income would follow the marginal propensity to save and consume. Therefore, calculate the multiplier if the marginal propensity to consume is 0.8 or 80%. The investment multiplier quantifies the additional positive impact on aggregate income and the general economy generated from investment spending. It can be used to make a strong case for public investment, particularly in a period of deep depression and widespread unemployment.

The marginal propensity to invest is the proportion of an additional increment of income that is spent on investment. A typical company might consume 90% of its income on such payments, meaning that its MPS—the profits earned by its shareholders—would be only 10%. Suppose, the government of a country spends Rs 100 crore on building roads. National income of the country automatically rises by Rs 100 crore in Round 1. Value of investment multiplier varies between zero and infinity.

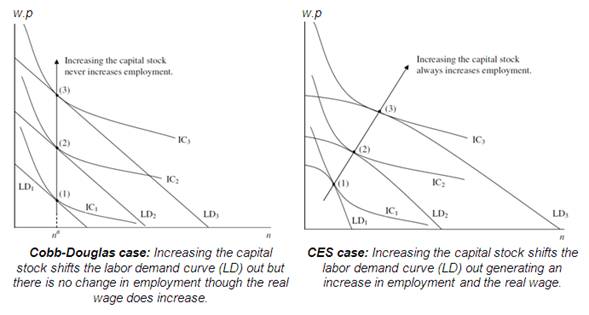

In case of low MPC, people will spend lesser proportion of their increased income on consumption. In such case, value of multiplier will be comparatively less. In case of higher MPC, people will spend a large proportion of their increased income on consumption.

In that case, real GDP turns out to be a winner because it does not consider the inflationary prices and keeps the focus fixed on the actual production. The money supply is the entire stock of a nation’s currency and other liquid instruments that is in circulation at a given time. Multiplier effects may also impact economies in different ways. First, economies experience direct impacts when an economic factor is directly attributed to an entity.

We know that one man’s expenditure is another man’s income. All information is subject to specific conditions | © 2023 Navi Technologies Ltd. Best Arbitrage Mutual Funds to Invest in India in March Arbitrage funds are hybrid mutual fund schemes that aim to make low-risk profits by buying and sell… 10 Best Gold ETFs in India to Invest in March Gold ETFs or Gold Exchange Traded Funds are passively managed funds that track the price of physica…

Investment Multiplier

In reality any multiplier increase in income hardly gets distributed evenly throughout the population. The concept has brought into focus the important point that employment is directly created by investment. It has also clearly revealed that income is generated throughout the economy due to secondary consumption spending . Therefore, a country has to spend some money on imports. However imports do not add to domestic expenditure and is unlikely to have any income and employment effect.

In short, the multiplier refers to the effects of changes to investment outlay on aggregate income through induced consumption expenditures. Thus, the multiplier establishes a quantitative relationship between an initial increment of investment and the resulting increase in aggregate income. The term Investment Multiplier is an important contribution made by Prof. J.M. Keynes. Keynes felt that an initial rise in investment multiplies overall income by a large factor. The relationship between an initial increase in investment and the subsequent rise in total revenue is expressed by the multiplier. In other words, a multiple of a change in investment equals a change in income.

If banks are lending more than their reserve requirement allows, then their multiplier will be higher, creating more money supply. If banks are lending less, then their multiplier will be lower and the money supply will also be lower. Moreover, when 10 banks were involved in creating total deposits of $651.32, these banks generated a new money supply of $586.19, for a money supply increase of 90% of the deposits. If the reserve requirement is 10%, then the money supply reserve multiplier is 10 and the money supply should be 10 times reserves.

This formula works on the premise that one person’s expenditure is the income for another person apart from that portion which the earning person is saving. So, there is an assumption that one person’s expenditure is another person’s income in the form of profit, wages, salaries, etc. That person, in turn, spends it again, majorly on the consumption front. This circle continues until the saving equals the amount injected into the economy. When a customer makes a deposit into a short-term deposit account, thebanking institutioncan lend one minus the reserve requirement to someone else.

Economists and bankers often look at a multiplier effect from the perspective of banking and a nation’s money supply. This multiplier is called the money supply multiplier or just the money multiplier. The money multiplier involves the reserve requirementset by the Federal Reserve, and it varies based on the total amount of liabilities held by a particular depository institution. What is the range of values of investment multiplier ? Clarify the relation of investment multiplier with marginal propensity to consume and with marginal propensity to save . The same thing happens if there is consumption lag, i.e., if households who receive an increase in their income take time to adjust their consumption habits.

- The new level of investment is maintained steadily for the completion of the multiplier process.

- It is on the concept of expenditure of one is the income of the other.

- Private SectorThe private sector is a section of the national economy that the government does not own.

The basic premise upon which the investment multiplier works is that one individual’s expense is another person’s income. When governments spend money, a chain of consumption and expenditure increases the total income many times its original investment. The working of multiplier is based on the fact that ‘One person’s expenditure is another person’s income’. When an additional investment is made, then income increases many times more than the increase in investment. Let us understand this with the help of an example. The basic idea behind the theory of multiplier is that of the induced consumption as a result of increased investment.

Relationship between Investment Multiplier and MPC (Marginal Propensity to consumer).

Hence, inverse relationship exists between MPS and multiplier. If the value of marginal propensity to consume is 0.6, calculate the value of multiplier. Want to put your savings into action and kick-start your investment journey 💸 But don’t have time to do research? Invest now with Navi Nifty 50 Index Fund, sit back, and earn from the top 50 companies.

It is rooted in the economic theories of John Maynard Keynes. In other words, change in income is a multiple of the change in investment. Multiplier explains how many times the income increases as a result of an increase in the investment. Spending Rs.50 crore will be the income of another group. Thus this process of income generation from one group to another until aggregate income rises by 200 crore on account of initial increase in investment by Rs.100 crore. The concept of investment multiplier is an important contribution of Keynes to the theory of income and employment.

What Is a Multiplier?

When income reaches this higher level, an extra saving of Rs. 1000 crores will have been generated. Moreover since the rise in saving equals the initial rise in investment, the process of income change will ultimately stop. If, for instance, 1/5 or 20 per cent of income is withdrawn through saving, then the rise in income will come to a halt when income has risen by Rs. 5,000 crores. In case of a decrement in investments, a reduction in income starts taking place.

MPC and multiplier value are directly related to one another. The value of the multiplier increases with an increase in MPC, and vice versa. The concept of multiplier was developed based on the view that the expense of one person is another person’s income. The increase in investment raises the income of the people, a portion of which is used by people for consumption. The value of MPC; however, determines how much of the new income is to be spent on consumption. People will spend a large portion of their increased income on consumption in the case of higher MPC.

NCERT Solutions for Class 12 Macro Economics National Income Determination and Multiplier

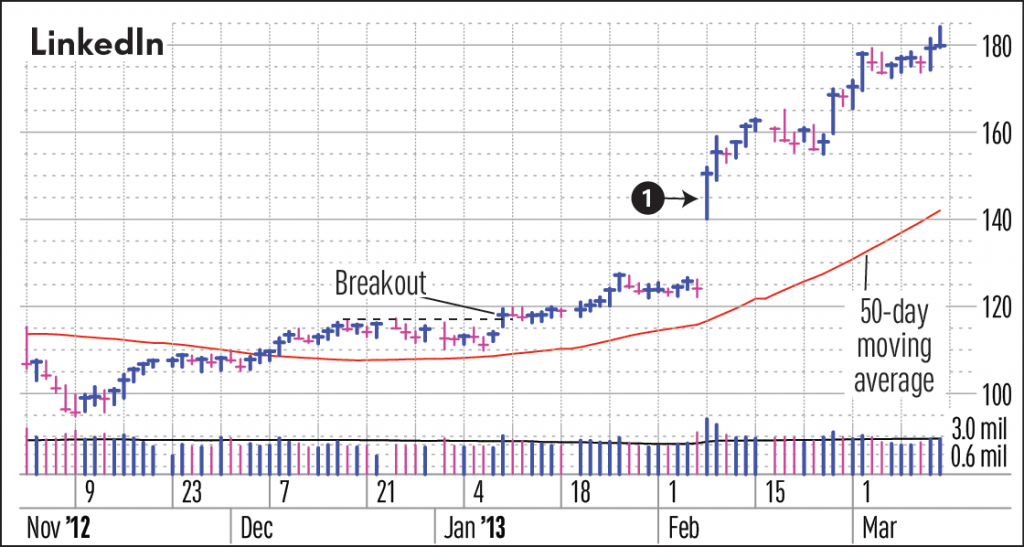

The multiplier effect is the proportional amount of increase or decrease in final income that results from an injection or withdrawal of spending. This, in its in turn, will lead to further multiplier process. That is, if investment like consumption depends on income or its change, the multiplier effect will be stronger. From this proposition Sir John Hicks developed the concept of super-multiplier. If we consider induced investment also, income change will be greater. A multiplier effect which increases consumption and brightens investment prospects will induce increases in investment.

Readers shall be fully liable/responsible for any decision taken on the basis of this article. It explains the wider economic impact of public projects such as the building of roads, ports and other infrastructure projects. This concept helps people better understand a trade cycle’s different phases. Third, marginal propensity to consume was assumed to remain unchanged in the entire process. In the below paragraph, we explained in details about the working of multiplier.

12 Best Investment Plans in India in March 2023 – Returns & Benefits Working extra hard to earn money? EPF Interest Rate The Employee Provident Fund is a Government-backed retirement savings scheme directed towards… National Pension Scheme The National Pension Scheme is a voluntary retirement savings sche… – Meaning, Types, Features and Benefits Treasury bills, otherwise known as T-bills, are money market instruments issued by the government o… Best One Time Investment Plans in During any stage of your life, you may require funds for specific purposes.

In any case some group in the community receives and income of Rs.100 cr. There is surplus capacity in consumer goods industries to meet the increased demand for consumer goods in response to a rise in income following increased investment. The deposit multiplier is key to maintaining an economy’s basic money supply. It reflects the change in checkable deposits possible from a change in reserves. Some multiplier effects are simply the product of metric analysis as one number is compared to another.